The latest news from Donald Trump’s administration about the intention to redistribute part of the subsidies allocated under the CHIPS Act shifted the market’s attention to rare earth minerals. This area remains one of the few where US dependence on supplies from China still persists, as these are necessary for the production of space and military equipment, modern electronics, as well as electric vehicles. Beijing’s attempt to restrict exports in this sphere has emerged as one of the main concerns of the White House today.

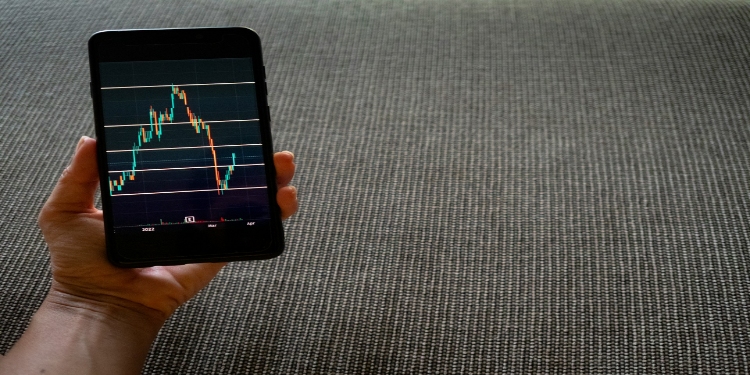

The markets reacted promptly to statements about the possible redirection of at least $2 billion in subsidies. The volatility of the S&P 500 index and the ES futures increased as investors priced political and structural risks into asset values. Dow Jones performance also reflected these concerns, with industrial stocks showing notable swings due to their reliance on rare earth supply chains.

The sharpest fluctuations are seen in stocks in the technological and industrial sectors, where the demand for rare earth materials is particularly high. For some companies, a potential solution to the problem reduces long-term risks. Conversely, for others, it raises uncertainty due to a possible reduction in funding for semiconductor programs.

If there are no further changes, money will likely be reallocated from funds that were previously intended to support the construction of new microchip plants and finance research projects. The redistribution of funds is expected to accelerate the reduction of the American economy’s dependence on supplies from China. An additional signal for the market was Donald Trump’s intention to give Secretary of Commerce Howard Lutnick more authority to coordinate the entire program related to rare earth minerals.

The CHIPS Act initially provided a total subsidy of $52.7 billion. Despite the formal distribution, many funds remain largely unavailable for companies. The White House believes it has the right to set new conditions for granting subsidies. In some cases, we may be talking about the transfer of controlling stakes to the state, which has already caused a wave of discussions about the limits of intervention in corporate governance.

At the same time, the redistribution of funds cannot be called completely inappropriate. The supply to the semiconductor industry directly depends on the supply of rare earth minerals, which means that solving the problem will indirectly strengthen the precise sector targeted by the law. It is possible that $2 billion will be only the first step, and the total amount of funding will be significantly larger.

Similar proposals were also considered during the Biden administration, but were rejected. The reasons were the programs’ high costs and the need to make environmental compromises when organizing the extraction and processing of minerals within the country. However, changed geopolitical circumstances have made the current administration’s position more flexible, and the issue has already gone beyond purely economic calculations.

Thus, the subsidy redistribution initiative reflects a strategic priority — reducing the United States’ vulnerability to possible Chinese sanctions.

For investors, this means increased uncertainty in the short term and the likelihood of a revision of market valuations of companies involved in the supply chain of rare earth materials. In the long term, the outcome will depend on how effectively the authorities can implement the program and reduce the dependence of key industries on external raw materials.

David Prior

David Prior is the editor of Today News, responsible for the overall editorial strategy. He is an NCTJ-qualified journalist with over 20 years’ experience, and is also editor of the award-winning hyperlocal news title Altrincham Today. His LinkedIn profile is here.

![7 Best POS Software in the UK [2026 Edition]](https://todaynews.co.uk/wp-content/uploads/2026/02/7-Best-POS-Software-in-the-UK-2026-Edition-360x180.png)