You have a business, and you want to start accepting payments fast. The only problem is – you have no development team under your wing. Maybe you’re a solo entrepreneur, and hiring someone is simply not viable, neither is learning to code by yourself.

No-code tools are designed to solve this problem. They encompass all realms of the digital world, beyond payments (for example, there are no-code website builders), and help create professional interfaces without technical skills. They bring huge value to smaller businesses, freelancers, and individual creators.

“Most people aren’t technical,” said Ben Sehl, director of product for Shopify, about the benefits of no-code builders “and even if they are, they don’t have time to fiddle with code every time they want to tweak something.” In payments, no-code tools cut the reliance on complex software.

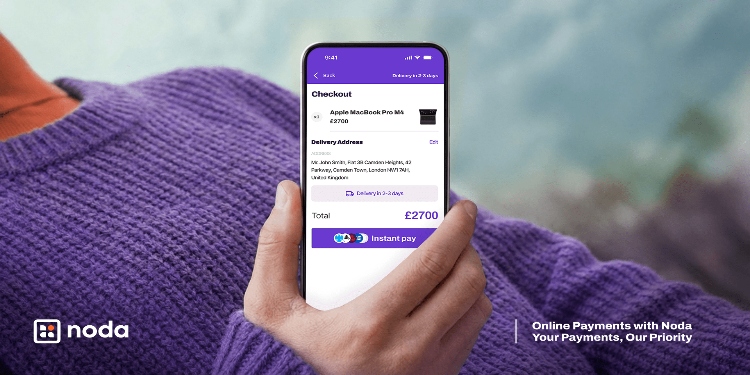

Noda Live: Payment Page in 10 Minutes

There are some pioneering providers in this space. For example, Noda Live, which in January last year launched no-code payment pages. With this tool, merchants can create branded landing pages to showcase multiple products. These pages are multi-purpose: businesses can add them to their social media, newsletters, or use them instead of a website, in case they don’t have one.

The page creation is extremely straightforward. First, merchants complete a survey with an AI-powered chatbot, which asks about their products, branding, and other features (with the option to add images such as logos). The AI then generates the payment page, which the merchant can edit and adjust. The whole process takes up to ten minutes.

No-code payment tools must not be confused with payment links – both of which Noda offers. While a payment link is a simple URL that directs the user to the checkout page, no-code payment tools offer more customisability and application methods, including QR codes that can be used for face-to-face payments.

Open Banking Made Accessible for Smaller Businesses

The advantage of Noda Live no-code payment pages also lies in the payment method they offer. Pay-by-bank, which runs on open banking, traditionally relies on integrating application programming interfaces (API), which requires technical expertise.

No-code payment pages make pay-by-bank accessible even for small businesses. Merchants can benefit from reduced processing costs, as open banking removes traditional card networks along with their interchange and scheme fees. At the same time, the checkout experience is smoother for customers, who approve payments directly in their banking apps instead of entering long card details, helping to lower drop-off rates. Security is also enhanced through the mandatory Strong Customer Authentication (SCA) that requires biometric authentication, such as fingerprint or face recognition.

Businesses that want to reach customers in the UK and EU are especially lucky – these are the two regions, where open banking flourishes. Open banking is actively used by over 16 million people in the UK, and by an estimated 63.8 million in Europe. Noda Live, for example, connects to 2,000+ banks in these regions.

Yet other countries are joining the suit. New Zealand, for example, is rolling out the new technology, while Canada has promised to add open banking in its forthcoming budget.

Noda Reviews of No-Code Payments

The accelerating adoption and its impact on the economies are evident. Yet what do these no-code tools actually mean for the merchants who work on the ground?

Feedback shared in Noda reviews on the company’s website suggests that customers quickly adapt to the technology. Kelly Ferreira, who runs the London-based Brazilian café Double Deli, noted that adoption was almost immediate after launch, with patrons finding the QR code–based, no-code payment flow easy to understand from the outset.

Similar observations appear in other Noda reviews from the UK. Donna Brown, owner of the family-run Barber Brown barbershop near Glasgow, reported strong customer acceptance, pointing out that the payment process is fast and flexible, while setup requires only a smartphone and access to Noda’s dashboard.

Where Next for No-Code Payments

With $480bn expected to be invested into AI in 2026 (up from $360bn in 2025), the trend is pushing no-code tools toward more automated builders and deeper integration with back‑end service.

For web and payments specifically, the direction is toward both front-end and back-end, so non‑developers can design full end‑to‑end flow, including payment orchestration.

And even in teams with experienced software engineers, data suggests that AI‑assisted development cuts time by half.

This is good news for smaller businesses – more flexibility (such as more accessible payment options, such as open banking), but also more control and creativity to play around with the payment flow. This is on top of much more cost efficiency – be it in terms of lower transaction fees, redundancy of expensive tech (such as card readers), or not needing extensive technical teams.