Introduction

Explore the UK BESS market. Our 2026 guide shows new chances from the 2030 plan. We make understanding BESS revenue streams effortless.

UK is one of Europe’s most attractive countries for Battery Energy Storage System (BESS) investment. It currently has the highest installed grid-scale BESS capacity in Europe and offers diverse revenue streams, strongly supported by the government and grid operators

Executive Summary:

The UK is one of Europe’s most attractive countries for Battery Energy Storage System (BESS) investment. It currently has the highest installed grid-scale BESS capacity in Europe and offers diverse revenue streams, strongly supported by the government and grid operators.

The UK government has set an ambitious target: to achieve clean energy production equal to its consumption by 2030. This goal drives significant growth in renewable energy and requires increased flexibility in the energy system, primarily through BESS.

A key question remains whether market conditions are sufficiently attractive to secure the BESS capacity required by the system.

Due to the further increase in renewable energy generation capacity, reforms to the balancing mechanism, and price erosion in frequency services, energy arbitrage is set to play an increasingly important role in the BESS revenue stack.

Despite existing uncertainties, the UK BESS market, driven by government plans and market data, still offers significant opportunities for growth and innovation. Investors should stay informed, be adaptable, and seek partnerships to navigate potential challenges.

I. The UK Leads the European Battery Energy Storage System Market

We identify the UK as one of the most attractive European countries for Battery Energy Storage System (BESS) investment. The UK currently holds the highest grid-scale BESS installed capacity, offers the most diverse revenue streams, and receives strong support from the government and grid operators for increasing BESS capacity. In this article, we will delve into the UK BESS market, exploring the main opportunities and key challenges for current and potential investors.

The UK government has formulated ambitious plans aimed at reforming the energy sector and building a clean and reliable system. In December 2024, the newly appointed Labour government released the “Clean Power 2030 Action Plan,” setting a target for the UK to produce at least as much clean electricity as it consumes by 2030. Achieving this goal will require a substantial increase in renewable energy sources such as solar and wind. This, in turn, requires greater flexibility in the UK’s energy system—for example, in the form of battery energy storage. The UK is a global leader in grid-scale BESS deployment and one of the first countries to actively pursue BESS investment. Due to limited interconnection capacity and a heavy reliance on wind power, the UK requires BESS to ensure the stability of its electricity system.

II. Clean Power 2030 Action Plan: Opportunities for BESS

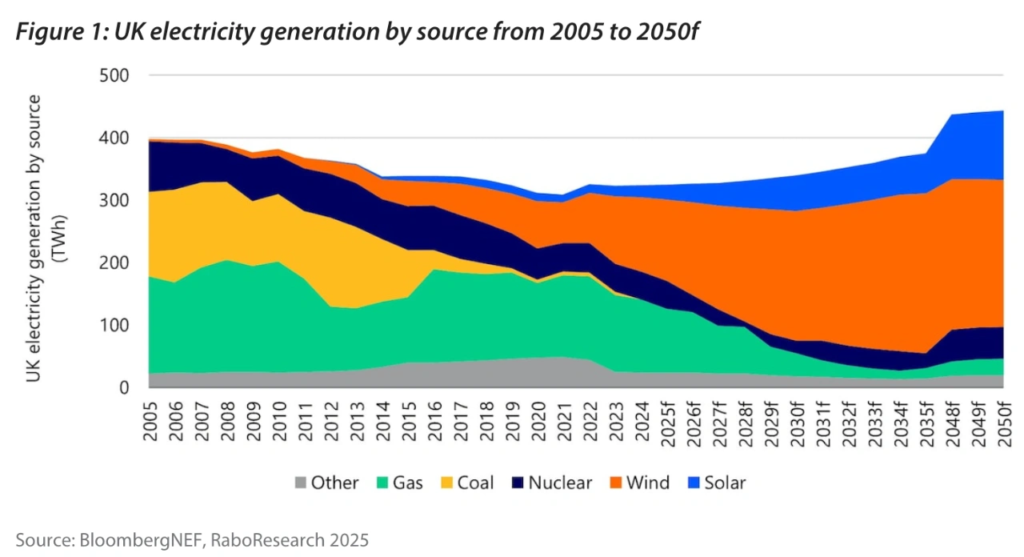

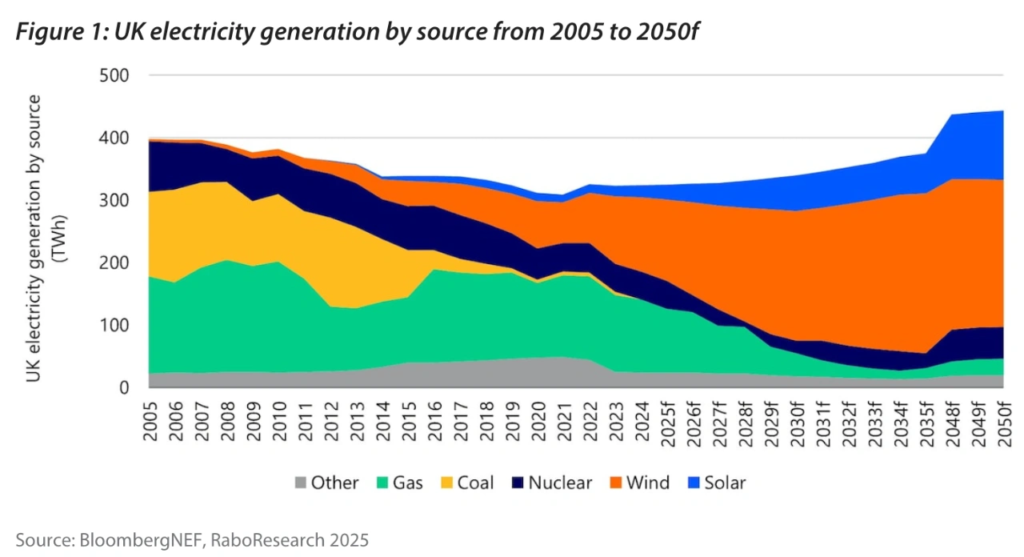

The UK’s electricity system is rapidly evolving. In 2005, most electricity was generated from coal, natural gas, and nuclear power (see Fig 1). In the same year, wind and solar provided less than 1% of the UK’s electricity. Fast forward to 2025, wind and solar now produce close to half of the UK’s electricity, while the last coal-fired power plant has just closed.

1: UK Electricity Generation by Source, 2005–2050

Source: BloombergNEF, RaboResearch 2025

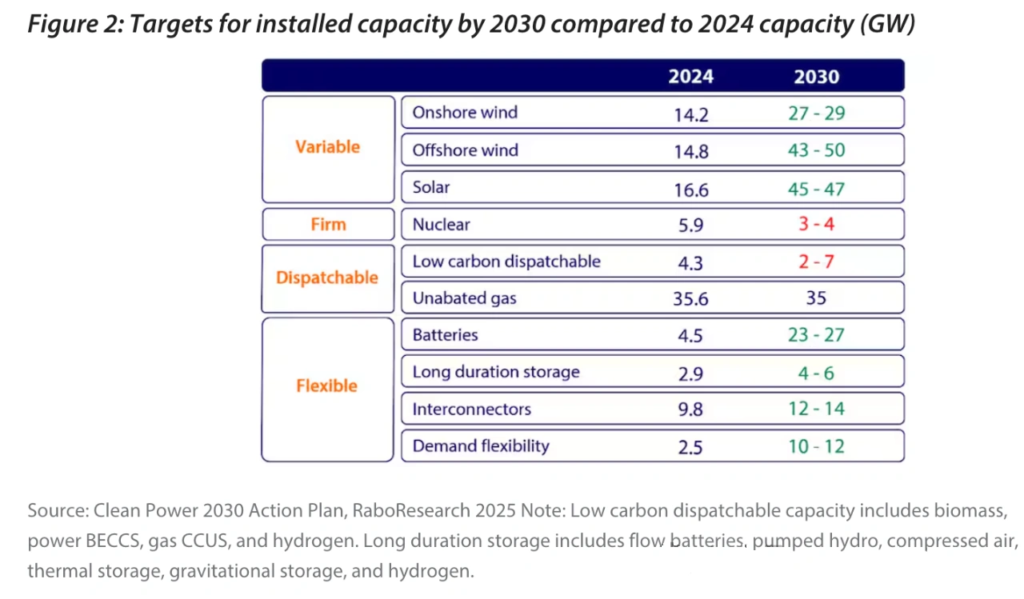

In the coming decades, renewable energy generation is expected to grow to 80% of electricity supply. This vision is supported by the government’s latest targets in the Clean Power 2030 Action Plan (see Fig 2). According to the plan, installed capacity for variable renewable energy generation will increase significantly, while stable and dispatchable capacity will largely remain the same. A substantial amount of additional flexible sources will be needed to accommodate the higher variability in the generation mix.

2: 2030 Installed Capacity Targets (GW) Compared to 2024 Capacity

(Source: Clean Power 2030 Action Plan, RaboResearch 2025 Note: Low-carbon dispatchable capacity includes biomass, power BECCS, natural gas with CCUS, and hydrogen. Long-duration storage includes flow batteries, pumped hydro, compressed air,) thermal storage, gravity storage, and hydrogen storage.

Batteries are expected to play the largest role in providing flexibility to the UK grid. The “Clean Power 2030 Action Plan” projects that BESS installed capacity will increase sixfold from 4.5 GW in 2024 to between 23 GW and 27 GW by 2030. This anticipated capacity significantly exceeds the 14 GW to 16 GW expectation we reported in the first part of this series, which was based on BloombergNEF scenarios. Current installation plans (see Fig 3) indicate that achieving the national target is possible. According to the European Energy Storage Repository recently launched by the European Commission, as of early March 2025, installed capacity has already increased by 1 GW compared to the 4.5 GW stated in the “Clean Power 2030 Action Plan.” If we also consider projects currently under construction and those already permitted, capacity reaches 20 GW, with another 18 GW of projects announced. However, achieving up to 27 GW of battery capacity by 2030 will depend on many factors, particularly investor and developer confidence in the return on investment (ROI). Reduced confidence could lead to a slowdown in project commissioning, as seen in 2024, with decreased revenues due to frequency market cannibalization. Although declining battery prices will improve the investment case for new projects by lowering CAPEX requirements, investors and developers must be aware of the dynamics affecting the available revenue streams for BESS assets.

3: Cumulative Operational BESS Capacity, Project Pipeline, and National Targets

Source: BloombergNEF, European Energy Storage Repository (European Commission), Clean Power 2030 Action Plan, RaboResearch 2025 Note: Installed capacity as of March 4, 2025.

III. Navigating the Diverse and Dynamic UK BESS Revenue Structure

The UK’s BESS revenue structure is one of the most diverse in Europe. Most UK wholesale markets and ancillary services allow energy storage to participate as an independent entity (see Fig 4), but the dynamics of each revenue stream can change significantly over time, complicating business strategy design.

4: UK BESS Revenue Structure

Source: BloombergNEF, National Energy System Operator (NESO), Modo Energy, RaboResearch 2025

IV. Shift in Energy Storage from Prioritizing Frequency Response Services to Energy Arbitrage Services

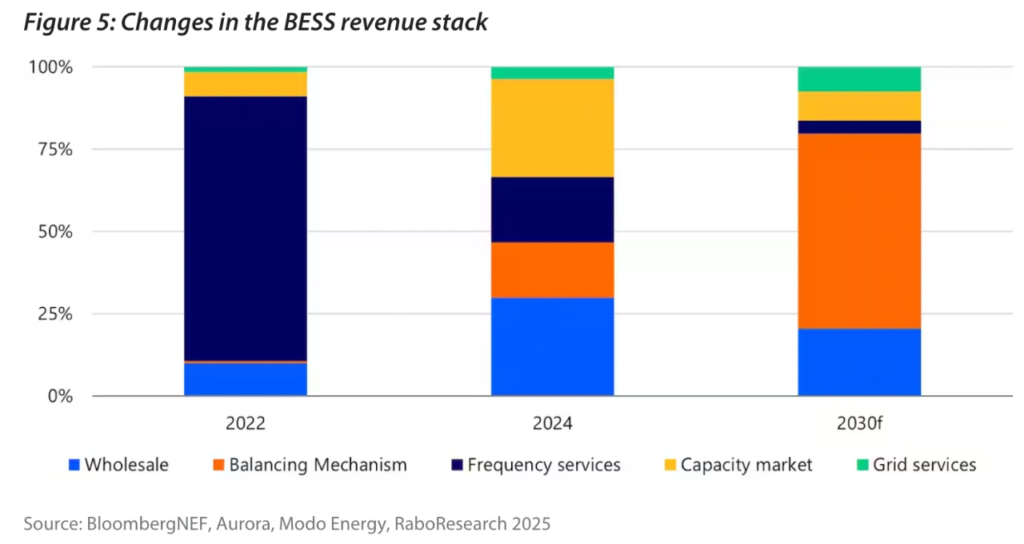

The composition of a typical BESS project’s revenue stack is by no means static (see Fig 5); the focus of energy storage has shifted from frequency services to energy arbitrage. Due to market saturation, the share of frequency services in the revenue stack has significantly declined, from 80% in 2022 to just 20% in 2024. Looking ahead to 2030, we expect energy arbitrage to dominate the revenue stack, with most revenue coming from participation in the balancing mechanism.

5: Evolution of BESS Revenue Stack

Source: BloombergNEF, Aurora, Modo Energy, RaboResearch 2025

In the following sections, we will dissect the different revenue streams and their anticipated roles in the future of UK BESS projects.

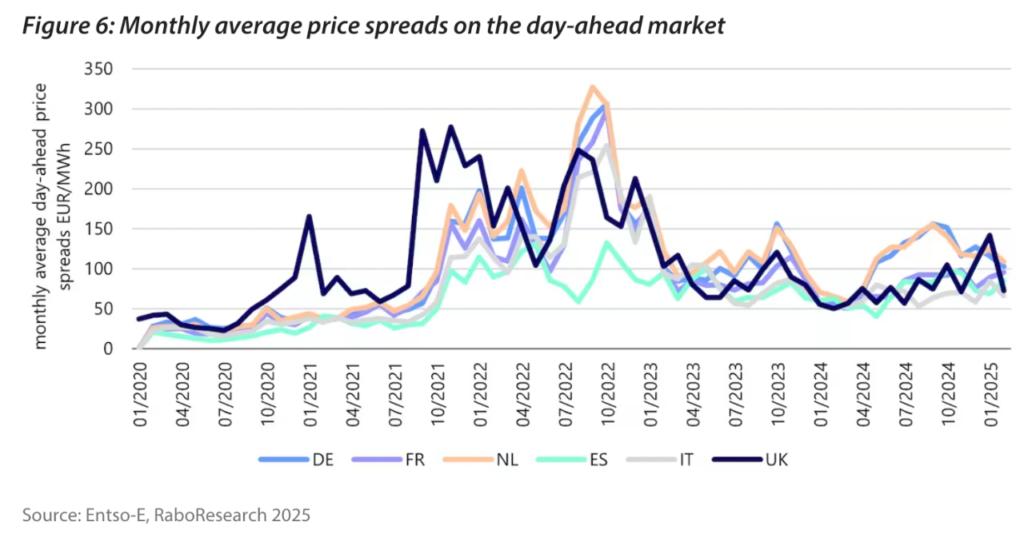

4.1 Energy Arbitrage in Wholesale Markets

Over the past two years, energy arbitrage has become the most significant revenue stream in wholesale markets. In 2022, it accounted for approximately 8% of the average BESS revenue stack. By 2024, according to Modo Energy data, energy arbitrage accounts for nearly 50% of average project revenue, and this proportion is expected to increase in the coming years. The revenue potential of energy arbitrage largely depends on the electricity generation structure. Due to the UK’s smaller solar generation capacity, summer spreads are lower than in Germany and the Netherlands (see Fig 6). In winter, spreads tend to increase. Wind power generation leads to lower minimum prices, while rising natural gas prices lead to higher maximum prices.