Mutual funds are becoming one of the most popular ways to invest in the UAE. And it is not hard to see why.

You don’t need to be an expert or watch the market every day. Mutual funds let you invest in a mix of assets like stocks or bonds through a single fund that is managed by professionals.

And guess what?

Some of the top performing mutual funds in UAE, like the Fidelity 500 Index Fund (FXAIX) gave a 26.35% return in the past year alone (as of August 2025).

If you are planning to invest in mutual funds, we will make the research part easier. In this blog, you will find the top 5 mutual funds in UAE, how they perform, and what you need to know before investing.

Fun fact

According to the UAE’s Securities and Commodities Authority (SCA), over 30 mutual funds are now registered locally. This gives investors easy access to both local and international markets

Why mutual funds are catching on in the UAE?

Investing sounds stressful, right? But mutual funds take out most of the hassle. And that is exactly why more people in the UAE are going this route.

Instead of buying individual stocks or bonds, mutual funds let you invest in a whole basket of assets at once.

It spreads the risk.

It also saves time.

You don’t need to track every market move. A fund manager does that for you.

And here’s something important – As of April 2024, the UAE’s Securities and Commodities Authority (SCA) made new rules to protect everyday investors.

Now, only funds that are registered locally can be publicly offered to retail investors. That means UAE residents have access to regulated and safer options without needing to dig into offshore funds.

Want to start with a small amount? Some platforms like Standard Chartered UAE lets you invest with as little as AED 1,000. That is how easy it is to begin.

Top 5 mutual funds in the UAE

These five mutual funds have shown strong past performance and are available for UAE investors. We have picked a mix of growth-focused and income-generating funds – so there is something for every goal.

| Fund Name | Fund Type | 1-Year Return | Risk Rating | Expense Ratio |

| BlackRock Global Funds – World Financials Fund A2 | Equity (Sector-based) | 57.46% | High | 1.80% |

| Allianz Global Intelligent Cities Income Fund (AMg USD) | Hybrid (Equity + Bonds) | 24.04% | Moderate | 1.65% |

| Fidelity 500 Index Fund (FXAIX) | Passive Equity (S&P 500) | 26.35% | Medium | 0.015% |

| Voya Russell Large Cap Growth Index Fund (IRLNX) | Passive Equity (Growth) | 9.04% (YTD) | High | 0.430% |

| Shelton NASDAQ-100 Index Direct (NASDX) | Passive Equity (NASDAQ-100) | 25.73% | High | 0.51% |

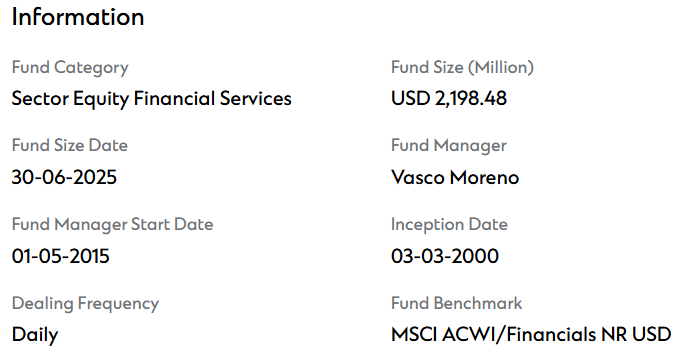

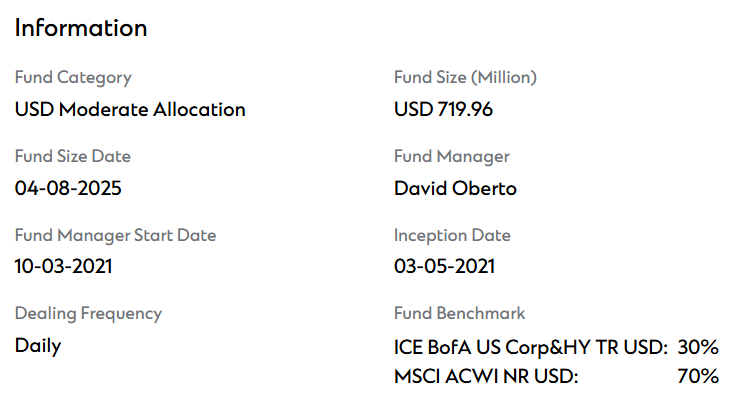

1. BlackRock Global Funds – World Financials Fund A2

This is an equity mutual fund managed by BlackRock that invests primarily in companies within the global financial sector. That includes big banks, insurance firms, payment companies, and financial technology players.

It is managed by Vasco Moreno, who has been handling this fund since May 2015. The fund also follows ESG investing principles. It is part of BlackRock’s large fund ecosystem and is available globally, including for UAE investors.

Performance

It is a high-growth fund that has outperformed in recent years.

- 1-year return: 57.46%

- 3-year return: 30.89%

- 5-year return: 21.00%

- 2024 calendar year return: 30.94%

- 2023 calendar year return: 27.86%

Features

This fund is not for someone looking for monthly income or a stable return. It is designed for long-term capital growth and performs best when the global financial sector is booming.

- Invests at least 70% in financial sector stocks globally

- ESG-compliant investment process

- Heavy exposure to US banks and financial institutions

- Includes up to 20% exposure to China via Stock Connect

- Risk rating is very high

- Expense ratio: 1.80%

- Managed by one of the top global asset managers (BlackRock)

Top holdings

- Bank of America

- Citigroup

- Goldman Sachs

- PayPal

- UBS Group

- Wells Fargo

This is one of the best mutual funds for growth-focused investors who are okay with short-term ups and downs.

How to invest

You can invest in this fund through UAE banks like Standard Chartered or global platforms that offer mutual funds. Just log in to your investment account, search for “BlackRock Global Funds – World Financials Fund A2”, and contact the team to place your order.

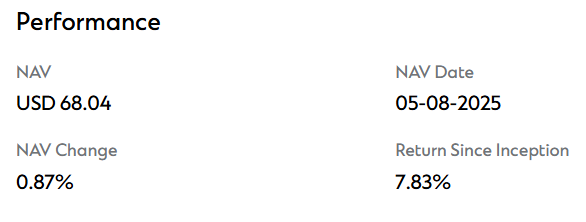

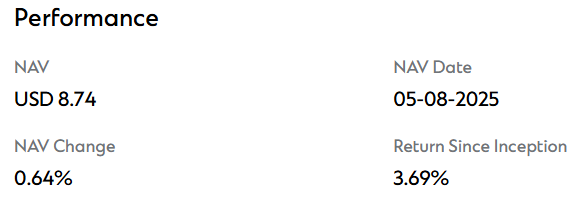

2. Allianz Global Intelligent Cities Income Fund (AMg USD)

This one is different. It is a thematic hybrid fund that invests in both stocks and bonds. The focus is on companies shaping the future of smart cities, like – technology, infrastructure, automation, and urban innovation.

Managed by David Oberto since 2021, the fund is designed to give investors a mix of growth and regular income. It is part of the Allianz Global Investors AE feeder fund range and accessible in the UAE.

Performance

- 1-year return: 24.04%

- 3-year return: 9.40%

- 2024 return: 13.54%

- 2023 return: 17.38%

It also pays a monthly dividend with a yield of 7.60%, which is a standout feature for income seekers.

Key features

- Thematic focus on smart cities

- Invests roughly 49% is in equities

- Asset mix: stocks, bonds, convertibles

- Monthly dividend payouts

- ESG-focused portfolio

- Risk rating is moderate

- Expense ratio: 1.65%

Top holdings

- Broadcom Inc.

- Meta Platforms Inc.

- NVIDIA Corp

- Hitachi Ltd

- Cloudflare Inc.

- Amphenol Corp

3. Fidelity 500 Index Fund (FXAIX)

The Fidelity 500 Index Fund is a passive equity mutual fund that tracks the S&P 500 Index, which includes 500 of the largest U.S. companies. Instead of active stock picking, it mirrors the performance of the entire U.S. market. It is built for long-term growth and is one of the most popular index funds globally due to its stability and low cost.

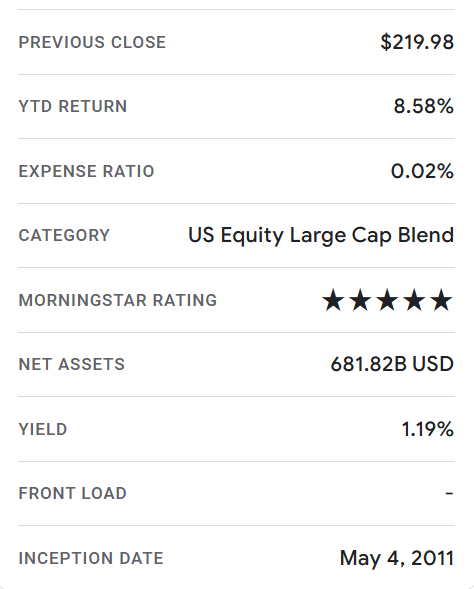

Performance

- 1-year return: 26.35%

- 5-year average return: 14.63%

- 2024 return: 26.29%

- 2023 return: 18.25%

- Expense ratio: 0.015%

It is also highly liquid and available through major UAE platforms and banks.

Key features

- At least 80% of the fund is invested in S&P 500 stocks

- Low-cost structure

- Diversified across all major U.S. industries

- Suitable for long-term investors

- Expense ratio is just 0.015%

- Risk rating is medium risk

Top holdings

- Apple Inc.

- Microsoft Corp

- NVIDIA Corp

- Amazon.com Inc.

- Alphabet Inc.

4. Voya Russell Large Cap Growth Index Fund (IRLNX)

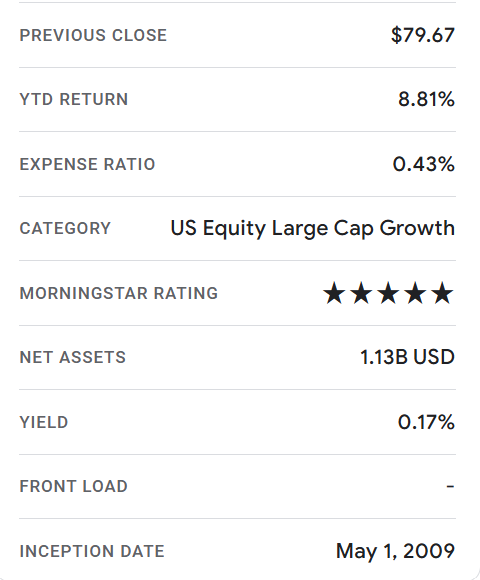

This is a growth-focused index fund that tracks the Russell Top 200 Growth Index. It invests in large U.S. companies with strong earnings and high growth potential. The fund doesn’t try to beat the market – it simply mirrors this index. It is ideal for investors who want exposure to fast-growing U.S. businesses without picking individual stocks.

Performance

- YTD 2025: 9.04%

- 2024 return: 32.69%

- 2023 return: 45.99%

- 3-year average return: 14.75%

- 5-year average return: 19.72%

Key features

- Follows the Russell Top 200 Growth Index

- Focused on large-cap U.S. growth stocks

- Invests at least 80% in index-tracked companies

- Passive investment strategy

- Suitable for long-term growth

- Expense ratio is 0.430%

- Risk rating is high

Top holdings

- Apple Inc.

- Microsoft Corp

- NVIDIA Corp

- Alphabet Inc.

- Amazon.com Inc.

5. Shelton NASDAQ-100 Index Direct (NASDX)

This is a passive equity fund that tracks the NASDAQ-100 Index – a collection of the 100 largest non-financial companies listed on the NASDAQ exchange. That means you are investing in big tech, e-commerce, and innovation-focused businesses. This is one of the top mutual funds built for growth and follows the index closely without active management.

Performance

- 1-year return: 25.73%

- 3-year average return: 13.37%

- Low-cost structure with long-term growth potential

The fund has done well over the last few years.

Key features

- Tracks the NASDAQ-100 Index

- Heavy exposure to tech and innovation

- Passive fund with lower fees

- Focused on long-term capital appreciation

- Regularly rebalanced to follow index changes

- Expense ratio is 0.51%

- Risk rating is high

Top holdings

- Apple Inc.

- Microsoft Corp

- Amazon.com Inc.

- NVIDIA Corp

- Meta Platforms Inc.

How to choose the right mutual fund?

Use this checklist to choose the best mutual funds in UAE. Just answer these questions to shortlist the options.

What is your goal?

Are you saving for retirement or looking for regular income?

How long will you invest?

Longer time frames allow more risk. Shorter ones need more stability.

How much risk can you handle?

Some funds, like NASDX or BlackRock World Financials, tend to swing more, while others, like the Allianz Income Fund, are steadier.

How was the past performance?

Look at past performance, but don’t rely on it blindly. Check who manages the fund. And always read the factsheet.

Want help estimating your potential return?

Use a mutual fund calculator – just plug in how much you plan to invest and for how long. It will show you what your money might grow into.

Also, don’t forget fees. Even a small difference in expense ratio can affect your return over 5 to 10 years.

How to invest in mutual funds online in the UAE?

You don’t need to walk into a bank or hire a private advisor to start investing anymore. You can do it online in just a few steps.

1. Choose an investment platform

Many UAE banks like Standard Chartered let you invest in mutual funds through their online banking apps. You can also explore international platforms that allow UAE residents.

2. Open an investment account

Complete basic KYC steps and link your bank account.

3. Search for the fund

Use the fund’s name or code in the fund search section.

4. Place your order

Choose between a one-time investment or set up a SIP for regular monthly investing.

5. Track and manage online

You can monitor performance, set alerts, or even switch funds anytime.

Note: Make sure to read the fund factsheet before investing. If you are unsure, many platforms offer a call-back or advisor chat option.

FAQs

What is mutual fund and how does it work?

A mutual fund is a pool of money collected from many investors. That money is then invested in stocks and bonds. A professional fund manager decides where the money goes. When the assets grow, so does your share of the fund. You don’t need to manage anything yourself.

Can I invest in mutual funds in the UAE as an expat?

Yes. Expats can easily invest in mutual funds in UAE through local banks or licensed investment platforms. Most major banks offer both international and UAE-domiciled funds to residents.

What are the best mutual funds for beginners in the UAE?

Index funds like Fidelity 500 Index Fund or Shelton NASDAQ-100 Index Fund are great starting points. They are diversified and have low fees. The Allianz Income Fund is also a good pick if you want monthly payouts.

How do I use a mutual fund calculator?

A mutual fund calculator helps you see how your money could grow over time. You enter your investment amount, expected return rate, and duration. The tool then shows your future value.

How do I invest in mutual funds online in the UAE?

Open an account with a UAE bank or investment platform. Search for top mutual funds you want. Decide the amount and invest – either all at once or monthly. That is it. You can invest in mutual funds online without needing paperwork or in-person visits.

David Prior

David Prior is the editor of Today News, responsible for the overall editorial strategy. He is an NCTJ-qualified journalist with over 20 years’ experience, and is also editor of the award-winning hyperlocal news title Altrincham Today. His LinkedIn profile is here.