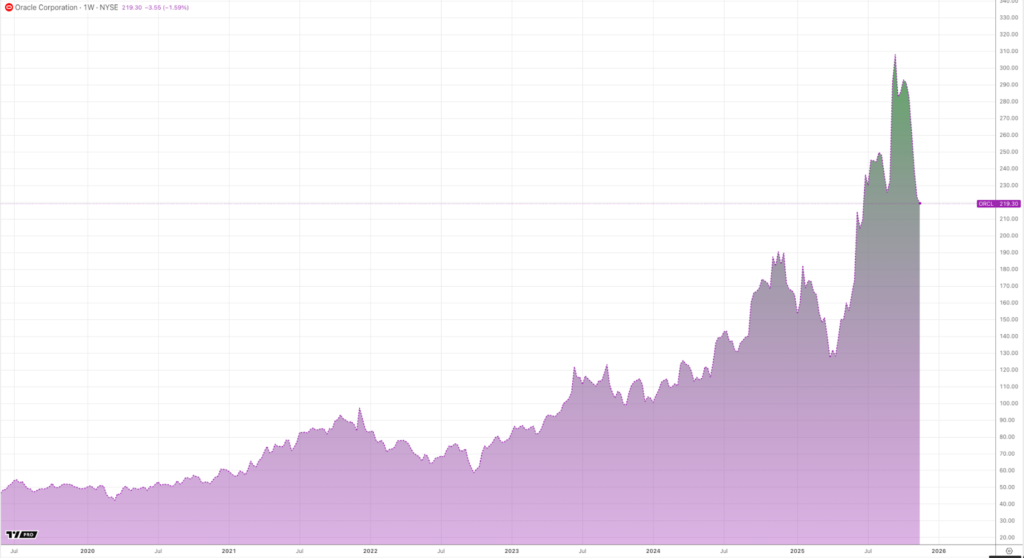

With the ongoing AI boom, financial swings have once again highlighted the volatility of markets at the intersection of cloud technology, AI infrastructure, and the fortunes of tech billionaires. In September, Larry Ellison briefly overtook Elon Musk as the richest man in the world, thanks to the rapid growth of Oracle shares — a clear signal that the segment was overheating. But recent events have gone even further, when Oracle’s securities soared by more than 40% in a single morning, recording the largest daily capitalization gain in the company’s history and pushing its position up on the stock screener.

The surge drove the quotes to $340, boosting Ellison’s fortune, as he owns 41% of the shares, to $393 billion. This moment not only set a record for daily market capitalization growth but also temporarily returned Ellison to the top of the wealth rankings, ahead of Musk, who was estimated to be worth $384 billion on the list. Formally, Oracle has reached a capitalization of over $1 trillion, significantly altering the dynamics of ES futures. Such a result was considered unattainable for a company that stood in the shadow of technology giants.

The reason is straightforward — Oracle has finally become a key infrastructure provider for AI companies. Its data centers are heavily used by OpenAI and others, while demand for powerful cloud computing continues to grow faster than investors can adjust their expectations. Paradoxically, this very rise, thanks to the AI giants, created vulnerability. Once the market doubts the AI monetization speed, the company’s securities fall. That happened after the September peak, when Oracle’s capitalization dropped by almost 30%, and Ellison’s fortune sank to $275 billion. In contrast, Musk, whose assets are diversified across Tesla, SpaceX, and other projects, recovers more easily from such corrections.

However, the key takeaway isn’t about billionaires’ fortunes — it is about the risks that the market prefers to overlook. The AI segment today operates as a giant leveraged system, where expectations are more expensive than actual results. Companies like Oracle are valued more for their potential future demand for data centers than for their current profitability. Investors are pumping capital into the sector faster than it has time to confirm the effectiveness of new monetization models. In this context, a single weak report, a minor slowdown, or a change in market sentiment can trigger a rapid decline in market value.

The relationship between Ellison and Musk appears as a contradictory mix of rivalry and alliance. Ellison has long acted as an informal mentor to Musk, serving on Tesla’s board and investing $1 billion in the purchase of Twitter/X. They are also politically aligned, as both supported Donald Trump and participated in infrastructure initiatives regarding AI development in the United States. Despite Musk’s public criticism of many business and political figures, he remains more closely connected with Ellison than it seems from the outside, and regular visits to Lanai Island confirm this.

Today, the value of technology is increasingly determined not by past achievements but by market expectations. Ellison rises to the top of the rating, Musk regains his position, and corporate capitalization swings by tens of percent in a single day. In this race, it is important to understand that AI has become not only a growth tool but also a source of market fragility. The critical question remains whether reality can withstand the pressure of those expectations already built into valuations.

David Prior

David Prior is the editor of Today News, responsible for the overall editorial strategy. He is an NCTJ-qualified journalist with over 20 years’ experience, and is also editor of the award-winning hyperlocal news title Altrincham Today. His LinkedIn profile is here.