Introduction

Investment is one of the fastest moving industries and using the latest technology can help you stay ahead and make your decisions better. With artificial intelligence shaping stock analysis tools, there’s more need than ever to have the right tools at your disposal to help diligently navigate the depths of the market. For experienced investors, business owners interested in improving their investment moves, or newcomers who want to see what using data-driven insights is all about, the proper AI stock analysis tools can give you the tools to make better decisions.

In this post, we introduce the best 5 AI driven stock analysis tools of 2025, carefully picked for you to discover new opportunities and get the most out of your investments. In our calculations, we include crucial aspects like features, pricing, user experience and overall value so you can get all the details needed to make an educated decision on what’s the best solution for your unique situation. Jump in and see how these revolutionary trading tools can help you take your stock market game to a whole new level.

Website List

1. beststock

What is beststock

About BestStock

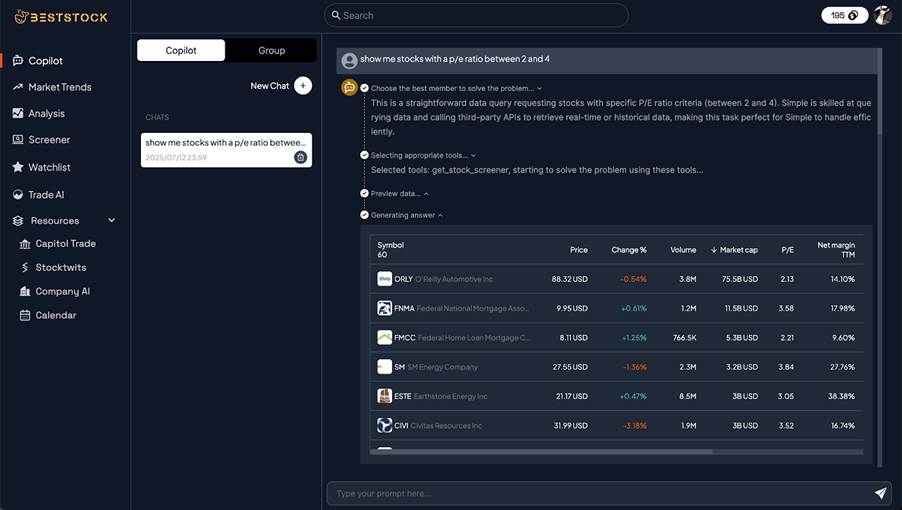

BestStock is stock analysis software that uses artificial intelligence to help investment teams more effectively analyze financial data. It powers the data pipeline and provides real time actionable insights to facilitate quick decisions. We offer a range of premium tools & analysis focused on getting the most of your gaming & e-sports stocks, including our industry-leading Dividend Calendar, as well as a host of other well-researched articles to help you make informed investment decisions and continue to increase your investment knowledge. Work smarter with BestStock Officiallio.

Features

• AI-enabled financial analysis for machine processing and insights, with no manual effort

• Full access to US Stock financials and earnings transcript for informed trading or investing.

• Daily reflections from a leading AI stephen to help you take advantage of market insights and strategy

• Comprehensive data analysis for statistical and financial analysis and business tasks that meets your requirements

• User-centric interface for a smooth and efficient research process and data management

Pros and Cons

Pros:

• AI-based analytics automation saves bringing in data, time and manual work

• Encyclopedic coverage of U.S. stock financials and earnings transcripts for informed investing decisions

• User-friendly research process promotes ease of use and yields rapid results

• Frequent updates with new insights and curated research to help investors stay informed

Cons:

• Possible higher cost associated with some competing financial analysis software

• Lack of strong offline capabilities could prevent you from accessing important data in low connectivity scenarios

• Not all features in the desktop version of the site are also available on the mobile version

Best for who

• Investment Teams: Perfect for those who want to standardize their investment process by quickly generating reports and sharing actionable insight to make data-driven decisions with attention-grabbing reports and AI-driven insight.

• Analysts and Insight Subscribers: Perfect for those who need the full picture on company financials and access to transcript sources, as well as access to detailed stock financials and company earnings for in-depth financial analysis.

• AI-Driven Startups: Ideal for startups whose businesses rely on business analysis to accelerate the business and that need to process financial data such as accounting documents quickly and efficiently, use AI automation to generate actionable insights, and avoid spending time on manual data processing.

2. simplywall

What is simplywall

Simply Wall St Simply Wall St is a software solution designed to reduce unnecessary time spent on sleepless nights and endless research. With strong emphasis on easy-to-use charts and graphs, it literally pares down investment research for even the most seasoned investor. The product enables users to easily invest through smart decisions as the workload on manual research is eliminated and experiences are enhanced in investing.

Features

- Easy-to-use interface to quickly find and research good potential stocks from over 5000 companies and save naturally valuable time of investors

- A set of powerful tools that provide new and experienced investors with the best way to research and manage their investments

- Ethical customer services which dedicated to make you satisfied and no

- A beautiful design approach to present data in a clear way to highlight investment opportunities.

- Ongoing feature additions based on user feedback to optimize the investing experience

Pros and Cons

Pros:

• Ideal for investors of all levels, it provides the ability to monitor portfolio inside and out

• Offers thorough details and analysis that include time-saving research aids

• An intuitive app that makes it easy to stock track your favouritetrading stocks inventory and have a quick view on the stock market status!

• A responsive and helpful team means great support from people who know what they are doing

Cons:

• May take time to learn how to use all of their features properly

• Some investors might wish it offered more customization for certain ways of investing

• Absolute beginners may feel overwhelmed by information overload

Best for who

• Beginner Investors: Ideal for individuals who are new to investing and want a simple platform to track their portfolio and learn more with very little prior knowledge.

• Technical Traders: Performance-minded traders will appreciate full access to extensive and advanced analysis tools to help streamline the search process.

• Portfolio Managers: A great option for those managing numerous investments, featuring company information and performance data to help manage and strategize.

3. levelfields

What is levelfields

LevelFields is an AI-enhanced stock trading platform to augment your trading strategies, regardless of whether you’re a rookie or a wall street pro. Its primary goal is to empower users with the most extensive data, customizable alerts and expert guidance through subscription plans to help them make better trading decisions and to maximize their investment potential. Whether trading on your own (direct access trading) or by an analyst, LevelFields is confidence the stock market.

Features

- Different levels: Level 1 for the DIYer and Level 2 for additional support and insights

- Trade preferences alerts that fit your style of trading for fast reaction, if necessary.

- Access to full set of data situations and trends which impact investment strategy

- One-on-one training sessions as provided with XTrades to achieve to ensure you get the most out trading platform and sharpen your trading skills

- Specialised customer service to answer any of your questions and streamline your overall experience

Pros and Cons

Pros:

• Plan 1 offers deep access to scenarios, data, and custom alerts for self-directed users

•Level 2 Plan offers private training and analyst alerts for a better experience

• Flexibility to upgrade from Level 1 to 2, with possible cost offsets for current subscribers

• Full support via our Customer Service for bothdescriptions levels

Cons:

• Level 1 forgoes human help and individualized coaching, potentially alienating newcomers

• Fewer data years provided at Level 1 than Level 2; the limited data may hinder long-term analysis

• No Level 2 to Level 1 downgrades except in rare cases, which may lack flexibility for users

Price

• Free Plan: Limited features (to 10 operations/month) without limitations

• Starter Plan: $25/month – Unlimited access to core functionality, 100 operations/month

• Professional Plan : $49/month – advanced features, unlimited runs, priority support

• Enterprise Plan: Contact for pricing – Private cloud, dedicated instances, custom integrations, priority support

4. stocktitan

What is stocktitan

Stock Titan is the world’s 1st free AI-based stock market news platform focusing on individual stocks in real time. Its primary goal is to deliver traders and investors with lightning-fast information, notified through its news summary feature, enabling them to make informed decisions depending on the most recent market happenings. With powerful tools such as Rhea-AI, Stock Titan offers personalized insights and sentiment analysis to keep users ahead of the ever-changing trading and investment landscape.

Features

• Prospector: Have our AI read the news for you and deliver only the most relevant information as it breaks in real-time, with lightning-fast updates for each individual stock

• Smart personal assistant Rhea-AI with real-time impact & sentiment analysis to take your trading to the next level

• Breaking news alerts and critical insights to help you stay ahead in the stock market

• News focused on the stock market from only news sources • Filter what you want to see and the stock news on the front page will adjust to fit your interests and market enthusiasm • Stock Notifications about today’s big opportunities when stock market opens!:semicolon

• Friendly user interface can be used by both novice traders and professionals and ensures everyone can enjoy it at ease

Pros and Cons

Pros:

• Lightning fast real-time AI curated news gets us the very best stories, for stocks.

• Sophisticated sentiment analysis and news summarization provide for better trading decisions

• There is a free version of the service for those who want to try out the service before committing, or simply do not need to perform very many searches every month

• Smart content filter, helps to focus on news, so that you get the news not the finance waste

Cons:

• Some of the advanced features might have a learning curve for people who aren’t acquainted with trading tools

• Lack of ability to customize for personal trading strategies or preferences

• Trusting in the AI analysis might not suit everyone who prefers old school research techniques

5. stockgeist

What is stockgeist

Stockgeist is a market sentiment tracking tool that uses AI to monitor up-to-the-minute social media chatter for 2,200 publicly traded companies. At its core, the BogTools platform is designed to give traders and investors access to actionable insights by converting mountains of data into easily digestible information that helps them understand market sentiment and make actionable decisions. With features as extensive as a financial QA chatbot and hedge fund enhancement tools, Stockgeist gives users a better sense of the way the markets are moving and where they might be headed.

Features

• Real-time market sentiment analysis via AI-driven deep learning algorithms reading live social media data

• Intuitive interface giving quick and easy access to most advanced analysis and trading tools.

• Have instant access to sentiment data on 2200+ public companies to make that decision whether to buy or sell a so much easier.

• Financial chatbot in real time with professional advice about securities and cryptocurrencies

• An arsenal to supercharge hedge fund performance with precise implementation of the market sentiment tracking

Pros and Cons

Pros:

• Groundbreaking AI-enabled platform delivering real-time sentiment analysis on nearly 2200 publicly traded companies

•Intuitive interface that lets traders make sense out of big data from social networks

• Financial chatbot providing instant analysis and advice on stocks and cryptos

• Great for hedge funds looking to improve portfolio performance by tracking market sentiment

Cons:

• Sentiment analysis using social media data might suffer from occasional inaccuracies

• Limited data analysis customization to specific trading strategies

• May be too much for beginners users to handle in terms of market sentiment monitoring sources

Best for who

• Active Traders: Suitable for pro-active traders who require fast decisions based on social media trend analysis.

• Hedge Fund Managers: Ideal for those fund managers who seeks to increase the profitability of their portfolio by applying A.I.-powered analysis on stock market sentiment to predict price movements.

• Analysts: Ideal for analysts who need rich, detailed social media information in order to perform more sophisticated analysis, facilitate decision making, and generate more actionable investment recommendations.

Key Takeaways

- Do your homework when selecting an AI stock analysis solution – some tools are better than others, some might use algorithms that are not up to date and start lacking on essential features.

- Think about your organization’s requirements and budget limitations when looking at options: if you only want core analytics compared to advanced predictive modeling, you might have a different solution in mind.

- Where possible, begin with free trials to test functionality, so you can gauge the user interface and the quality of insights available, before paying out for these kinds of tools.

- Keep up with what’s new in AI stock analysis; technology moves fast, so remaining informed helps you take advantage of new tools.

- Never underestimate good customer support, and the power of a support network, good troubleshooters can save you time and effort, especially when dealing with complicated software.

- Think about scalability and the possibility of future expansion when making a choice, and you’ll feel confident that you can implement a solution that best meets your growing trading strategies and investment portfolio.

Conclusion

And with that, we wrap up our tour of the best of breed in stock analysis powered by AI; a market that offers enough choices to suit all tastes and styles of investors. Success is by understanding what your investment needs are, and finding the tool that has all the balance of features that makes sense for you at the right price.

Whether you are a retail investor wanting to improve portfolio management or an experienced trader wanting to utilize superior predictive analytics, these are some of the top options out there. Both platforms have their own set of strengths, the algorithm-driving, intuitive-interface sporting, and world-class-customer-supporting kind of strengths.

However, we recommend using this guide as a jumping-off point, “where you can think about what types of problems you have, and then what sort of solutions those problems may have, and then test those hands-on…You just want to get your hands dirty with this stuff! AI in stock analysis is the future, and picking the right version for you today can transform your investment game for the next decade. So jump on in, have a look around, and let these new platforms help you make your investing journey its best.