The insurance industry, like many others, is experiencing rapid transformation driven by technological advancements, changing consumer expectations, and competitive pressures. One of the most significant shifts is the emergence of the hybrid sales model. This approach, which blends traditional face-to-face interactions with digital tools and platforms, is poised to redefine the future of insurance. Central to this transformation is the principle of “Know Your Customer” (KYC), which underpins the ability to offer personalized, efficient, and effective services.

The Evolution of the Hybrid Sales Model

Traditionally, the insurance industry has relied heavily on in-person interactions, with agents meeting clients to discuss policies, assess needs, and finalize sales. While this model offers the advantage of personalized service, it is also time-consuming and often less convenient for today’s digitally-savvy consumers. The rise of digital technologies has enabled a new model where online platforms, mobile apps, and virtual consultations complement and enhance the traditional methods.

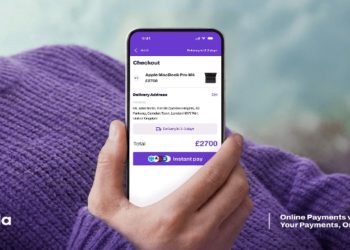

The hybrid sales model leverages the best of both worlds. It maintains the personal touch of human interactions while integrating digital tools to streamline processes, reduce costs, and enhance customer experience. For example, initial consultations and information gathering can occur online, reducing the time required for face-to-face meetings. Digital platforms can provide instant quotes, policy comparisons, and even virtual reality experiences to help clients understand complex products.

Know Your Customer (KYC) in the Digital Age

The concept of “Know Your Customer” (KYC) is critical in the insurance industry. It involves verifying the identity of clients, understanding their needs and preferences, and assessing risks accurately. In a hybrid sales model, KYC processes are significantly enhanced by digital tools. Advanced data analytics, machine learning, and artificial intelligence (AI) enable insurers to gather and analyze vast amounts of customer data efficiently.

By utilizing digital KYC tools, insurers can automate the verification process, reducing the risk of fraud and ensuring compliance with regulatory requirements. Moreover, data analytics can provide deeper insights into customer behavior and preferences, allowing for more tailored and relevant product offerings. For instance, AI-driven algorithms can predict which policies are most suitable for a customer based on their demographics, financial situation, and lifestyle.

Benefits of the Hybrid Sales Model

- Enhanced Customer Experience: Customers today expect seamless, omnichannel experiences. The hybrid model allows insurers to meet these expectations by offering multiple touchpoints – from online self-service portals to personalized consultations. This flexibility ensures that customers can interact with their insurer in the manner that best suits their needs and preferences.

- Increased Efficiency and Cost Savings: By automating routine tasks and streamlining processes, the hybrid sales model reduces the administrative burden on agents and lowers operational costs. This efficiency translates into cost savings for the insurer, which can be passed on to customers in the form of competitive pricing.

- Improved Risk Assessment: Digital tools enhance the accuracy of risk assessments by providing a more comprehensive view of the customer. This improved accuracy helps insurers price policies more precisely and offer products that better match the customer’s risk profile.

- Scalability: The hybrid model is inherently scalable. Digital platforms can handle large volumes of transactions and interactions simultaneously, allowing insurers to expand their customer base without a proportional increase in operational costs.

Challenges and Considerations

While the hybrid sales model offers numerous benefits, it also presents challenges. Data privacy and security are paramount, as the increased reliance on digital tools means that more sensitive customer information is stored online. Insurers must invest in robust cybersecurity measures to protect this data and maintain customer trust.

Additionally, the integration of digital tools requires significant investment in technology and training. Insurers must ensure that their workforce is skilled in using new tools and platforms, and that they are able to maintain the personal touch that differentiates them in a competitive market.

The Future of Insurance

The hybrid sales model is not just a trend; it represents a fundamental shift in how insurance is sold and serviced. As technology continues to evolve, the model will become increasingly sophisticated, offering even more personalized and efficient customer experiences. The key to success in this new landscape will be the ability to seamlessly integrate digital tools with human expertise, underpinned by a deep understanding of the customer – the essence of the “Know Your Customer” principle.

In conclusion, the future of the insurance industry lies in embracing the hybrid sales model. By combining the strengths of traditional methods with the advantages of digital innovation, insurers can meet the evolving needs of their customers, improve operational efficiency, and stay competitive in a rapidly changing market. The journey to this future will require investment, innovation, and a relentless focus on understanding and serving the customer.