In an industry where volatility isn’t limited to markets alone, managing operational risk and meeting regulatory obligations demand a resilient digital foundation. Financial organisations are turning to options like Beeks private cloud platforms to bring structure, security, and oversight into environments that previously relied on fragmented legacy systems. These purpose-built infrastructures place financial firms back in control—over data, access, performance, and accountability.

Navigating the Compliance Maze with Confidence

Global finance operates under an intricate web of regulations—each with specific mandates around data residency, access control, retention, and breach response. Public infrastructure rarely aligns neatly with such demands. Private cloud solutions, however, offer a dedicated space where financial institutions can define how and where their data lives. Policies are enforceable, audits are streamlined, and external scrutiny becomes less burdensome when compliance is embedded into the platform itself.

Enhancing Data Protection and Privacy

Client confidentiality is non-negotiable. Private cloud frameworks support this by isolating workloads within single-tenant environments. Unlike shared public models, there’s no risk of data bleed, resource overlap, or unauthorised cross-access. Encryption standards can be tailored to fit jurisdictional laws, while real-time monitoring ensures potential threats are flagged before exposure occurs. This architectural insulation builds a digital perimeter around sensitive operations—one that’s both adaptive and resilient.

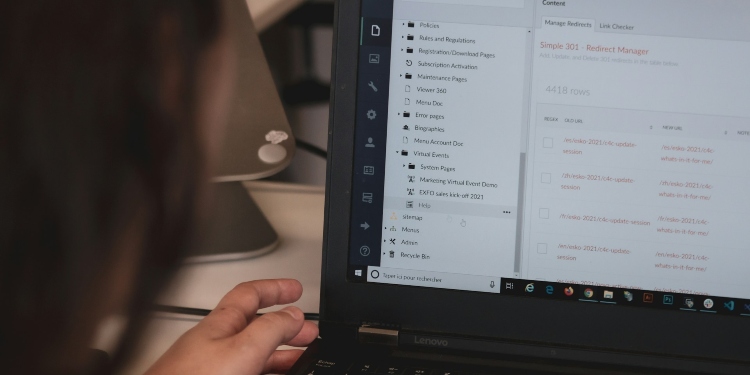

Real-Time Risk Mitigation Through Infrastructure Transparency

Without visibility, risk festers. Legacy setups often conceal performance bottlenecks and security gaps. Private cloud solutions allow deep telemetry across every layer of the stack—from storage to compute to network traffic. This visibility allows compliance officers and security teams to identify anomalies in real time, automate threat responses, and test resilience through active simulations. With infrastructure no longer acting as a black box, institutions reclaim oversight over operational risk.

Streamlining Audits and Governance

Regulatory reviews can paralyse operations when systems aren’t audit-ready. Private cloud environments support consistent logging, traceability, and access history without manual intervention. Auditors receive time-stamped, tamper-proof trails that meet evidentiary standards. Policy enforcement becomes programmatic—less prone to human error and infinitely more scalable across jurisdictions.

Adapting to Region-Specific Regulatory Requirements

International operations require nuanced compliance strategies. What satisfies European data protection might fall short of U.S. financial recordkeeping obligations. A one-size-fits-all infrastructure simply cannot support this. With private cloud infrastructure, regional configurations are easily isolated, customised, and governed according to local laws. This prevents cross-border data entanglement and mitigates the risk of fines or sanctions due to regulatory misalignment.

Supporting Secure Disaster Recovery Planning

Cyber breaches, hardware failure, or insider threats can all disrupt critical services. However, response time and restoration integrity separate operational inconvenience from existential threat. Private cloud systems are uniquely positioned to support rapid disaster recovery. Full-stack snapshots, encrypted offsite backups, and secure replication procedures allow institutions to recover with precision—without compromising compliance or data accuracy.

Enabling Policy-Driven Automation

Risk management doesn’t scale when handled manually. Private cloud services allow institutions to implement policy-driven automation, ensuring that permissions, security updates, and compliance workflows operate independently of human delays or inconsistencies. Rules are enforced at the infrastructure level, so every new user, deployment, or data transfer aligns with the organisation’s predefined risk profile.

Private Cloud as a Risk Governance Engine

Meeting regulatory requirements is more than a checklist—it’s a living framework of accountability and control. For financial institutions facing increased oversight, complex risk landscapes, and global data mandates, private cloud serves as more than a hosting solution. It functions as a governance engine, embedding compliance and resilience into every operational layer. In doing so, it helps financial firms not just survive scrutiny, but lead through certainty.

David Prior

David Prior is the editor of Today News, responsible for the overall editorial strategy. He is an NCTJ-qualified journalist with over 20 years’ experience, and is also editor of the award-winning hyperlocal news title Altrincham Today. His LinkedIn profile is here.

![7 Best POS Software in the UK [2026 Edition]](https://todaynews.co.uk/wp-content/uploads/2026/02/7-Best-POS-Software-in-the-UK-2026-Edition-360x180.png)

![7 Best POS Software in the UK [2026 Edition]](https://todaynews.co.uk/wp-content/uploads/2026/02/7-Best-POS-Software-in-the-UK-2026-Edition-350x250.png)